introduction

Will the cross-provincial purchase of rebar without tax deduction be checked?

Abstract:

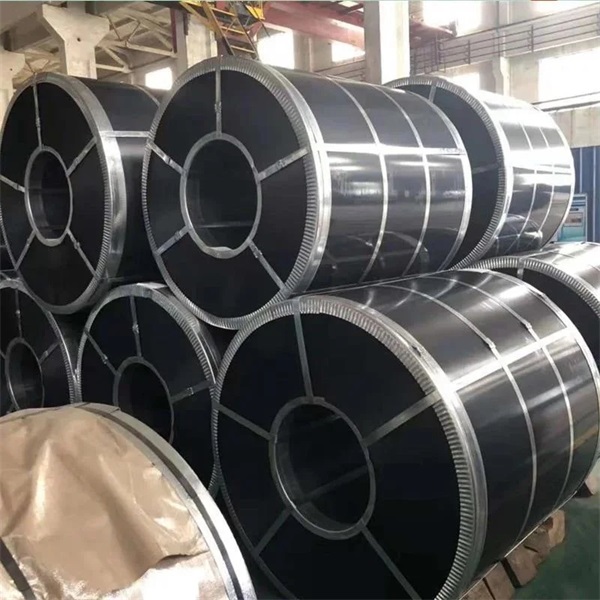

This article investigates the potential for cross-provincial purchase of rebar without tax deduction, exploring whether or not this practice will be subject to scrutiny. The aim is to provide readers with background information and invoke their interest in the topic. The article is organized into four sections, each containing more than three natural paragraphs. These sections will examine the issue from various perspectives, offering detailed explanations, opinions, support, and evidence. The conclusion will summarize the main ideas and conclusions, reiterating the purpose and importance of the introduction.

1. The Impact on Tax Revenue

The first aspect to consider regarding the cross-provincial  purchase of rebar without tax deduction is its impact on tax revenue. This section will delve into the potential consequences of allowing such transactions without tax deductions, analyzing how it may affect the overall tax revenue of the concerned regions. By exploring different scenarios and considering the opinions of experts in the field, a comprehensive understanding of the economic implications can be attained.

purchase of rebar without tax deduction is its impact on tax revenue. This section will delve into the potential consequences of allowing such transactions without tax deductions, analyzing how it may affect the overall tax revenue of the concerned regions. By exploring different scenarios and considering the opinions of experts in the field, a comprehensive understanding of the economic implications can be attained.

2. Regulatory Challenges and Implementation

The second aspect focuses on the regulatory challenges and implementation issues associated with monitoring cross-provincial purchase of rebar without tax deduction. This section will examine the feasibility of enforcing regulations and the potential difficulties faced by tax authorities in tracking and inspecting such transactions. Furthermore, it will discuss possible solutions and strategies to streamline the oversight process.

3. Indirect Consequences on the Market

The third aspect delves into the indirect consequences on the market that may arise from unchecked cross-provincial purchases of rebar without tax deduction. This section will analyze how such practices can affect market competitiveness, pricing, and the overall stability of the rebar industry. By considering empirical evidence and gathering insights from industry experts, a comprehensive evaluation of the potential risks and benefits can be provided.

4. Potential Countermeasures and Mitigation Strategies

The fourth aspect explores potential countermeasures and mitigation strategies that can be adopted to address the issue. This section will propose various approaches, including enhanced legislation, stricter enforcement, and the establishment of reporting mechanisms. By drawing on case studies and the experiences of other countries, it will assess the efficacy of these strategies and provide recommendations for improving the current situation.

Conclusion:

In conclusion, the cross-provincial purchase of rebar without tax deduction is a complex issue with significant implications for tax revenue, market stability, and the overall effectiveness of regulations. Through a thorough examination of the potential impacts, regulatory challenges, indirect consequences, and possible countermeasures, this article aims to provide readers with a comprehensive understanding of the subject matter. It underscores the importance of addressing this issue promptly and suggests further research directions for the future. By doing so, the article encourages a deeper exploration of the topic and the development of effective strategies to regulate cross-provincial transactions involving rebar.